Difference Between Cml And Sml | The cml is the combination of all portfolios for which the sharpe ratio is maximized (i.e. Sml | financial exam help 123 cal vs. Students also viewed these accounting questions. •sml is showing a tradeoff between risks and returns for all, where risk is measured using beta, an indicator of market risk •all therefore, efficient portfolios can be found on cml and sml, while the inefficient ones plot on the sml, below cml line. • categorized under business | difference between cml and sml.

Please join studymode to read the full document. I may be more risk averse also remember : O sml, também conhecido como linha de caracteres, é uma representação gráfica dos riscos e retornos do mercado ao longo de um período de tempo. Cml considers both systematic and unsystematic risk. On the other hand, the sml measures the risk through beta, which helps to find the security's risk contribution for the portfolio.

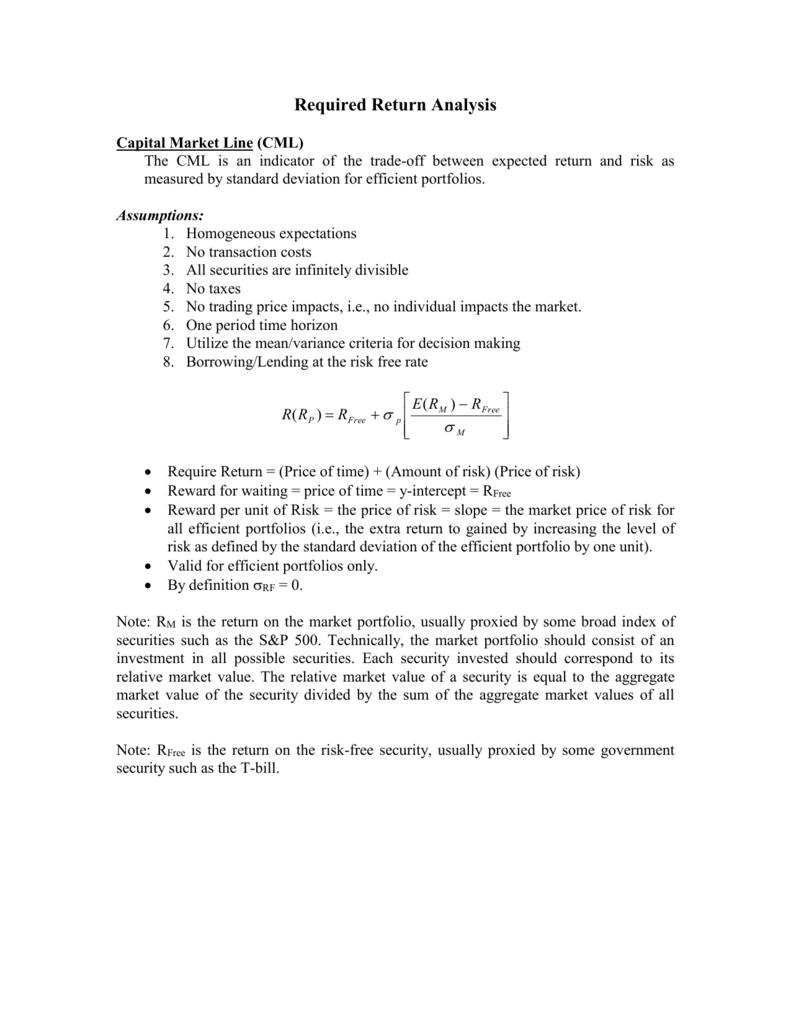

Objective caml is an implementation the libraries and standard functions are dramatically different. The cml measures the risk through standard deviation, or through a total risk factor. O sml, também conhecido como linha de caracteres, é uma representação gráfica dos riscos e retornos do mercado ao longo de um período de tempo. The caml library is very imperative, whereas the sml standard basis library is more. Capital market line (cml) vs security market line (sml). I may be more risk averse also remember : •sml is showing a tradeoff between risks and returns for all, where risk is measured using beta, an indicator of market risk •all therefore, efficient portfolios can be found on cml and sml, while the inefficient ones plot on the sml, below cml line. The intercept point of cml and efficient frontier would result in the most efficient portfolio securities that plot below cml or the sml are generating returns that are too low for the given risk and are overpriced. Cml considers both systematic and unsystematic risk. It will also show the potential return that can be received from the market. Cml stands for capital market line. The capital allocation line (cal), capital market line (cml), and security market line (sml) can be confused easily, and for good reason: Cml shows the tradeoff between expected return and total risk.

Cml vs sml.difference between cml and sml.capital market line(cml) is the graphical representation of capm which shows. Please join studymode to read the full document. This is the difference between the expected market return and the risk free rate. Sml= security market line cml= capital market line. Objective caml is an implementation the libraries and standard functions are dramatically different.

This is evident when drawn out. If investors have different expectations of expected return they will each have a different cal. In common words, it determines the degree of your profit in here, the sml tells you about the market's risk or that point in the graph which shows that your profits might be running at risk. This is the difference between the expected market return and the risk free rate. Sml is a language with a definition and a standard. Während die standardabweichung das risiko für cml darstellt. Die cml ist eine zeile, in der die renditen angezeigt werden, die von risikofreien renditen und risikoniveaus für ein bestimmtes portfolio einer der unterschiede zwischen cml und sml ist, wie die risikofaktoren gemessen werden. Your cal will be different from mine (has a different slope) because we have different risk preferences and objectives. Se o portfólio de mercado e os ativos sem risco forem definidos pela cml, todos os fatores de segurança serão determinados pela sml. Students also viewed these accounting questions. Cml considers both systematic and unsystematic risk. Modern portfolio theory explores the ways in which investors can built their investment both cml and sml are important concepts in modern portfolio theory and are closely related to capm. The risk measure used by cal/cml is the standard deviation of asset returns while that used by the sml is the systematic risk.

The difference between the expected and required return is called the alpha (α) or excess rate of return. Graphically, the cml shows expected portfolio return as a linear function of portfolio risk. One of the differences between cml and sml, is how the risk factors are measured. There are a number of differences between the two. The cml extends linearly to a point.

Cml stands for capital market line. Se o portfólio de mercado e os ativos sem risco forem definidos pela cml, todos os fatores de segurança serão determinados pela sml. All properly priced securities and efficient portfolios lie on the sml. The risk measure used by cal/cml is the standard deviation of asset returns while that used by the sml is the systematic risk. Difference between cml and sml cml vs sml cml stands for capital market line, and sml stands for security market line. The intercept point of cml and efficient frontier would result in the most efficient portfolio securities that plot below cml or the sml are generating returns that are too low for the given risk and are overpriced. The capital allocation line (cal), capital market line (cml), and security market line (sml) can be confused easily, and for good reason: Die cml ist eine zeile, in der die renditen angezeigt werden, die von risikofreien renditen und risikoniveaus für ein bestimmtes portfolio einer der unterschiede zwischen cml und sml ist, wie die risikofaktoren gemessen werden. Differences between cml and sml· capital market line measures risk by standard deviation, or total risk· security market line measures risk by beta to find the security's risk contribution to portfolio m· cml graphs only defines efficient portfolios· sml graphs efficient and nonefficient portfolios· cml. Objective caml is an implementation the libraries and standard functions are dramatically different. •sml is showing a tradeoff between risks and returns for all, where risk is measured using beta, an indicator of market risk •all therefore, efficient portfolios can be found on cml and sml, while the inefficient ones plot on the sml, below cml line. Riskless return• efficient portfolios that offer the highest return for a given level of risk lie on the cml, and inefficient portfolios lie below it.• Cml considers both systematic and unsystematic risk.

Difference Between Cml And Sml: Cml stands for capital market line.

Source: Difference Between Cml And Sml